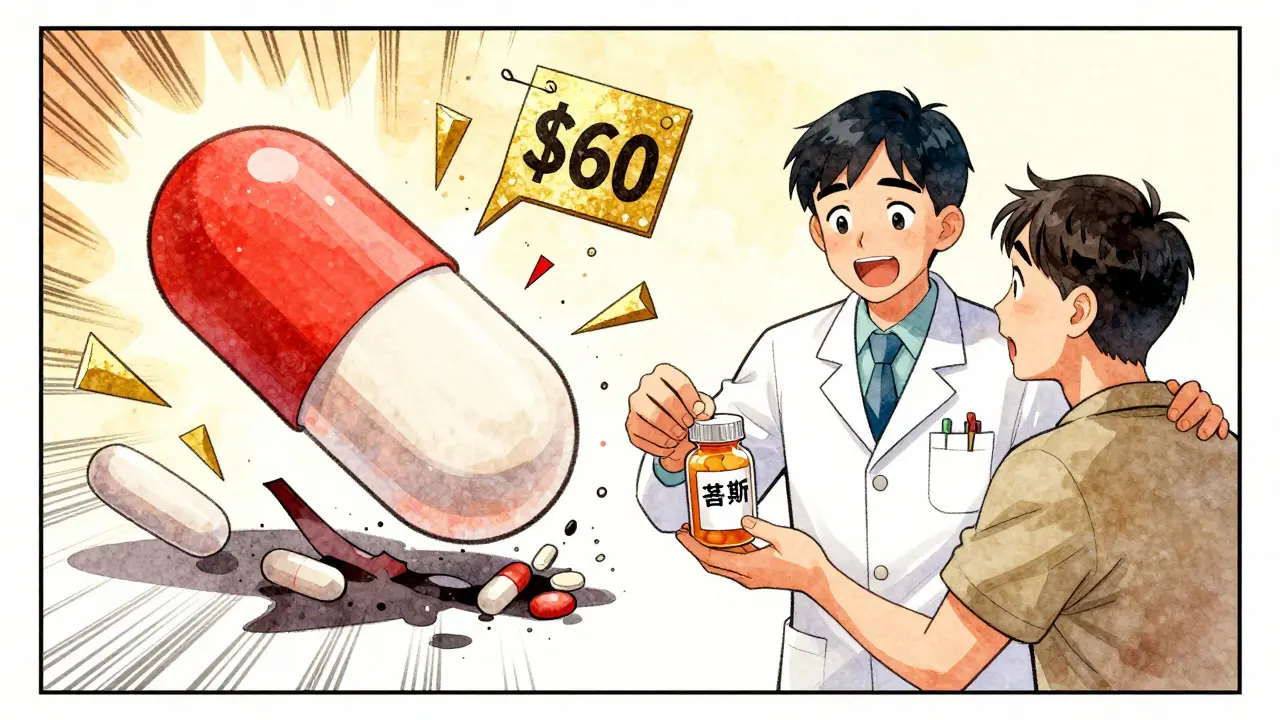

Most people don’t realize that the pill they pick up at the pharmacy might be nearly identical to a brand-name drug - but costs a fraction of the price. Generic medications aren’t cheap because they’re low quality. They’re cheap because they don’t carry the same financial baggage as their brand-name cousins. If you’ve ever wondered why your $60 prescription for a brand-name drug suddenly drops to $8 when you switch to the generic, here’s exactly why.

Same Drug, Different Price Tag

The FDA requires that generic drugs contain the same active ingredients, dosage, strength, and route of administration as the original brand-name drug. They must also deliver the same therapeutic effect. In other words, if your brand-name blood pressure pill works, the generic version does too - no guesswork, no compromise. The only difference? The name on the bottle and the price on the receipt.

How is that possible? Because generic manufacturers don’t have to start from scratch. When a brand-name drug’s patent expires - usually after 20 years - other companies can step in. They don’t need to repeat expensive clinical trials to prove safety or effectiveness. Instead, they only need to show that their version behaves the same way in the body as the original. This process, called bioequivalence testing, costs a fraction of the $2.6 billion it typically takes to bring a new brand-name drug to market.

Why Generic Drugs Are So Much Cheaper

The cost difference isn’t just about R&D. It’s about competition. When the first generic enters the market, prices usually drop to about 15-20% of the brand-name price. With each new generic manufacturer that joins, prices fall even further. In markets with three or more generic competitors, prices often drop another 20% within three years.

Take lurasidone (brand name: Latuda). Before generics, a 30-day supply cost around $1,400. After just one generic competitor entered, that price crashed to under $60. In another example, pemetrexed (Alimta) dropped from $3,800 per month to $500. These aren’t outliers - they’re standard. According to the FDA, the entry of generic drugs saved the U.S. healthcare system $408 billion in 2022 alone.

Insurers benefit too. Since generics cost so much less, they don’t trigger high deductibles or trigger cost-sharing tiers. The average copay for a generic drug in 2023 was $6.16. For brand-name drugs? $56.12. That’s nearly nine times more. And 93% of all generic prescriptions cost under $20. Only 59% of brand-name prescriptions do.

Not All Generics Are Created Equal

Here’s the catch: not every generic is cheap. Some generic drugs are priced almost as high as the brand-name version - sometimes even higher. How? It’s called spread pricing.

Pharmacy benefit managers (PBMs), the middlemen between insurers, pharmacies, and drug manufacturers, sometimes negotiate deals that reward them for choosing higher-priced generics. They profit from the gap between what they pay the manufacturer and what they collect from insurers or patients. This creates a perverse incentive: the more expensive the generic, the more the PBM makes. A 2022 study in JAMA Network Open found that some generic drugs were 15.6 times more expensive than other, equally effective alternatives. In Colorado, replacing just 45 of these overpriced generics saved $6.6 million in one year.

Patients rarely know this is happening. Their insurance might still cover the drug, but they’re paying more than necessary. The solution? Always ask your pharmacist: "Is there a cheaper generic alternative?" And don’t assume your insurance is getting you the best price.

How to Save Even More

If you’re paying cash, you can often beat your insurance price. A 2023 study found that 78% of people with high-deductible plans saved money by paying out-of-pocket for generics using apps like GoodRx or SingleCare. One man in Portland paid $18 for a 30-day supply of sildenafil (Viagra) using GoodRx - his insurance wanted $120.

Here’s how to do it:

- Ask your doctor to write "dispense as written" on your prescription. This lets the pharmacist substitute a generic if available.

- Use free price-comparison tools like GoodRx, SingleCare, or Blink Health. Enter your drug name and zip code - you’ll see prices at nearby pharmacies.

- Compare cash price vs. insurance copay. Sometimes, paying cash is cheaper even if you have insurance.

- Consider mail-order pharmacies for maintenance medications like blood pressure or diabetes drugs. Many offer 90-day supplies for the price of a 30-day retail fill.

One woman in Oregon saved $287 in a year just by comparing prices on her monthly medications. It took her five minutes per prescription. That’s less time than it takes to scroll through social media.

The Bigger Picture: Generics Are Saving Billions

Generic drugs account for 90% of all prescriptions filled in the U.S. - but only 1.5% of total drug spending. That’s the power of competition. Over the last decade, generics have saved the country $2.9 trillion. That’s not just money saved - it’s lives improved. People who can’t afford their meds skip doses. Generics keep them on treatment.

Even the FDA agrees: competition drives prices down. When multiple generic manufacturers enter the market, prices fall. When only one or two are available, prices stay high. That’s why the FDA has been approving more generics - 700 in 2022 alone. More competition means lower prices for everyone.

What’s Next? Biosimilars and Reform

The next wave of savings is coming from biosimilars - generic versions of complex biologic drugs like Humira and Enbrel. These used to cost over $70,000 a year. With biosimilars entering the market, prices are already dropping by 30-50%. Analysts predict biosimilars will save $150 billion between 2023 and 2027.

The Inflation Reduction Act is also helping. It caps insulin at $35 per month for Medicare patients and gives the government power to negotiate prices for other high-cost drugs. These changes will push more patients toward generics and biosimilars.

But challenges remain. Some generic drugs are still at risk of shortages - 202 were flagged by the FDA in early 2023. And the Department of Justice is still investigating "pay-for-delay" deals, where brand-name companies pay generics to stay off the market. These practices delay savings and hurt patients.

Bottom Line: Generics Work - and They Save

You don’t need to choose between effectiveness and affordability. Generics deliver the same results at a fraction of the cost. Whether you’re insured, uninsured, or on Medicare, asking about generics can save you hundreds - or thousands - each year.

Start small: next time you refill a prescription, ask your pharmacist: "Is there a generic?" Then check GoodRx. You might be shocked by how much you’re overpaying.

Are generic drugs as safe and effective as brand-name drugs?

Yes. The FDA requires generic drugs to have the same active ingredients, strength, dosage form, and route of administration as the brand-name version. They must also meet the same strict standards for quality, purity, and stability. Bioequivalence testing proves they work the same way in the body. Over 90% of prescriptions filled in the U.S. are generics - and they’ve been trusted for decades.

Why do some generic drugs cost more than others?

It’s not about quality - it’s about competition and pricing practices. When only one or two companies make a generic, prices stay high. But when multiple manufacturers enter, prices drop sharply. Sometimes, pharmacy benefit managers (PBMs) push higher-priced generics because they profit from the difference between what they pay the manufacturer and what insurers pay - a practice called "spread pricing." Always compare prices using tools like GoodRx to find the best deal.

Can I save money by paying cash instead of using insurance?

Often, yes. Especially if you have a high-deductible plan, your insurance copay might be higher than the cash price at a pharmacy. A 2023 study found that 78% of people saved money by paying cash for generics using price-comparison apps. For example, a $120 insulin prescription might cost only $35 cash. Always check both options before paying.

Do generics have different side effects than brand-name drugs?

No. The active ingredient - the part that affects your body - is identical. Differences in inactive ingredients (like fillers or dyes) may cause rare allergic reactions, but these are uncommon. The FDA monitors reports of adverse events for both brand and generic drugs. If you notice a change in how you feel after switching, talk to your doctor - but don’t assume the generic is the problem.

What’s the difference between a generic and a biosimilar?

Generics are exact copies of small-molecule drugs (like pills for blood pressure or cholesterol). Biosimilars are highly similar - but not identical - copies of complex biologic drugs (like injections for arthritis or cancer). Biologics are made from living cells, so exact replication isn’t possible. But biosimilars must prove they work the same way and have no clinically meaningful differences. They’re the next wave of cost savings, with potential to save $150 billion by 2027.

8 Comments

Let me get this straight - we’re celebrating generics like they’re some kind of socialist miracle when the real villain is the FDA’s patent game and the PBM cartel. You think competition drives prices down? Try 90% of generics being made by three Indian manufacturers with zero regulatory oversight. The pill you’re taking might be chemically identical - but is it bioequivalent? Or just legally convenient?

And don’t get me started on GoodRx. That app isn’t saving you money - it’s routing your cash through a private pharmacy network that’s been quietly siphoning off insurer funds for years. You’re not a savvy consumer. You’re a pawn.

Generics work? Sure. But so does putting duct tape on a leaking pipe. Doesn’t mean you shouldn’t fix the damn system.

The real tragedy isn’t the price of generics - it’s the epistemological surrender we’ve made in accepting them as ‘equivalent.’ We’ve reduced medicine to a chemical formula, stripped of context, of individual biochemistry, of the subtle art of therapeutic relationship. The FDA says ‘bioequivalent.’ But what does that mean when your body doesn’t respond to the same molecule the same way twice?

There’s a quiet grief in switching from brand to generic - not because it doesn’t work, but because we’ve stopped believing in the possibility of precision. We’ve normalized compromise. And that’s not progress. That’s resignation.

Oh please. You think this is about savings? This is about corporate greed wrapped in a lab coat. The FDA approves generics, sure - but only after the brand-name company has milked every last dollar from desperate Americans for 20 years. Then, boom - generic hits the market and suddenly it’s ‘affordable’? No. It’s still a rip-off. Because PBMs are still gouging you. They’re the ones who control which generic gets pushed. They get kickbacks. They make more money if you pay $120 instead of $8.

And you think GoodRx is your friend? It’s a Trojan horse. They’re not helping you - they’re collecting your data, selling it to insurers, and then using it to jack up your premiums next year. You’re not saving money. You’re being profiled.

And don’t even get me started on India. Half those generics are made in factories with no quality control. You think your ‘identical’ pill is safe? You’re just lucky you haven’t died yet. I’ve seen patients on Indian generics with liver failure. No one talks about that. Because it’s easier to blame Big Pharma than admit the whole system is rigged.

There’s something quietly beautiful about how generics democratize medicine. A single mother in rural Alabama can now afford her asthma inhaler. A veteran on fixed income can manage his diabetes without choosing between groceries and his pills. The numbers - $408 billion saved in 2022 - aren’t abstract. They’re lives.

Yes, PBMs are problematic. Yes, some generics are overpriced. But the solution isn’t to abandon generics - it’s to reform the middlemen. To demand transparency. To pressure lawmakers. To use GoodRx like the tool it is.

Generics aren’t perfect. But they’re the closest thing we have to a moral imperative in pharmaceutical policy: that health shouldn’t be a luxury. And for that, we owe them more than cynicism. We owe them our advocacy.

i just wanted to say thank you for this post. i’ve been on a generic for my thyroid for 3 years and i thought i was just ‘getting used to it’ when i felt sluggish - turns out the batch i got had a different filler and it messed with my absorption. my pharmacist helped me switch to a different generic and now i’m back to normal. i didn’t know that was even a thing. this made me feel less alone.

also - i’m terrible at spelling. sorry. i’m typing on my phone while my kid naps. but i’m so glad someone finally explained why my copay dropped from $80 to $5. it’s not magic. it’s math. and math is kinda beautiful.

So let me get this straight - you’re telling me the reason my $1400 drug is now $60 is because some guy in Bangalore woke up one day and said, ‘Hey, let’s copy this pill’? And now we’re all supposed to clap? How noble. How revolutionary. How… completely corporate.

It’s not innovation. It’s piracy with a FDA stamp. And you’re calling that progress? I’ll take my overpriced brand-name drug with its 37 clinical trials and my $600 deductible any day. At least I know what I’m paying for.

Generics are the quiet heroes of modern healthcare - like unsung poets who write the same sonnet in 12 languages and still make you cry. 💫

But here’s the truth no one wants to whisper: the system doesn’t want you to know how cheap generics really are. It wants you to think you’re saving money when you’re just being shuffled through layers of profit. PBMs? They’re the wizards behind the curtain. And GoodRx? A dazzling light show to distract you from the real puppet strings.

Still - I’ll take my $3 insulin over a $300 one any day. Sometimes, the imperfect solution is the only one left. And that’s okay. 🌿

Man I just switched my blood pressure med to generic and saved $150 a month. No joke. I used to think generics were sketchy - like, ‘is this even the same stuff?’ But then I asked my pharmacist and he showed me the FDA paperwork. Same active ingredient. Same dose. Same everything. Just no fancy branding.

And yeah, I checked GoodRx. My insurance copay was $48. Cash price? $12. I paid cash. No questions asked.

Also - my dog’s name is Biscuit. He’s a golden retriever. I just thought you should know.

Write a comment