When a brand-name drug hits the market, it’s protected by patents that can last 20 years or more. But those patents aren’t forever. And there’s a legal backdoor-called a Paragraph IV certification-that lets generic drug companies challenge those patents before they even make a single pill. This isn’t just a loophole. It’s the main reason 90% of prescriptions in the U.S. are filled with generic drugs today.

What Exactly Is a Paragraph IV Certification?

A Paragraph IV certification is a formal statement filed by a generic drug company when it submits an Abbreviated New Drug Application (ANDA) to the FDA. In that statement, the company says: "One or more patents listed for this drug in the Orange Book are either invalid, not infringed by our product, or unenforceable." That’s it. No product made. No sale yet. Just a legal notice saying, "We’re coming, and we think your patent doesn’t hold up."

This is possible because of the Hatch-Waxman Act of 1984. Before this law, generic companies had to wait until the patent expired to start selling their versions. That meant patients waited years longer for cheaper drugs. Hatch-Waxman changed that. It created a legal fiction: submitting an ANDA with a Paragraph IV certification is treated as an act of patent infringement-even if the generic drug hasn’t been made or sold. That lets the brand-name company sue immediately, instead of waiting for real harm to happen.

How the Process Works: A Step-by-Step Timeline

Here’s how it actually plays out in real time:

- A generic company files its ANDA with the FDA and includes a Paragraph IV certification against one or more patents listed in the FDA’s Orange Book.

- Within 20 days, the generic company must send a detailed notice to the brand-name drugmaker and patent holder, explaining why they believe the patent is invalid or won’t be infringed.

- The brand company has 45 days to file a patent infringement lawsuit. If they do, the FDA automatically puts a 30-month stay on approving the generic drug.

- During those 30 months, both sides litigate. The case can end in a settlement, a court ruling, or a dismissal.

- If the generic wins, or if the patent is found invalid, the FDA can approve the drug. The first company to file a Paragraph IV certification gets 180 days of exclusive market access-no other generics can enter during that time.

That 180-day exclusivity period is huge. For a blockbuster drug bringing in $1 billion a year, it means up to $500 million in pure profit for the first generic maker. That’s why companies spend millions on legal teams just to be first in line.

Why Do Brand Companies List So Many Patents?

It’s not just one patent anymore. In 2005, brand-name drugs had an average of 7.2 patents listed in the Orange Book. By 2024, that number jumped to 17.3. That’s not because the drug got 10 new inventions. It’s because companies are stacking patents-covering everything from the pill’s shape to the way it’s coated, the manufacturing process, even how it’s used for a secondary condition. This is called “patent thickets.”

The goal? Make it harder for generics to challenge them all. If a generic company misses one patent, or if one holds up in court, the whole approval can be delayed. And since every patent listed triggers a 45-day window for a lawsuit, brand companies can drag out the process by filing multiple suits.

According to data from 2024, 68% of major brand drugs face three or more Paragraph IV challenges. And 92% of those challenges result in at least one lawsuit. That’s not coincidence. It’s strategy.

What Happens When the Generic Company Wins

Winning a Paragraph IV challenge doesn’t just mean getting approval. It means a cash windfall. The first generic to file gets 180 days of exclusivity. During that time, they’re the only one selling the drug. No competition. No price drops from other generics. They can charge a premium-sometimes 80% less than the brand, but still far more than what the drug will cost once other generics enter.

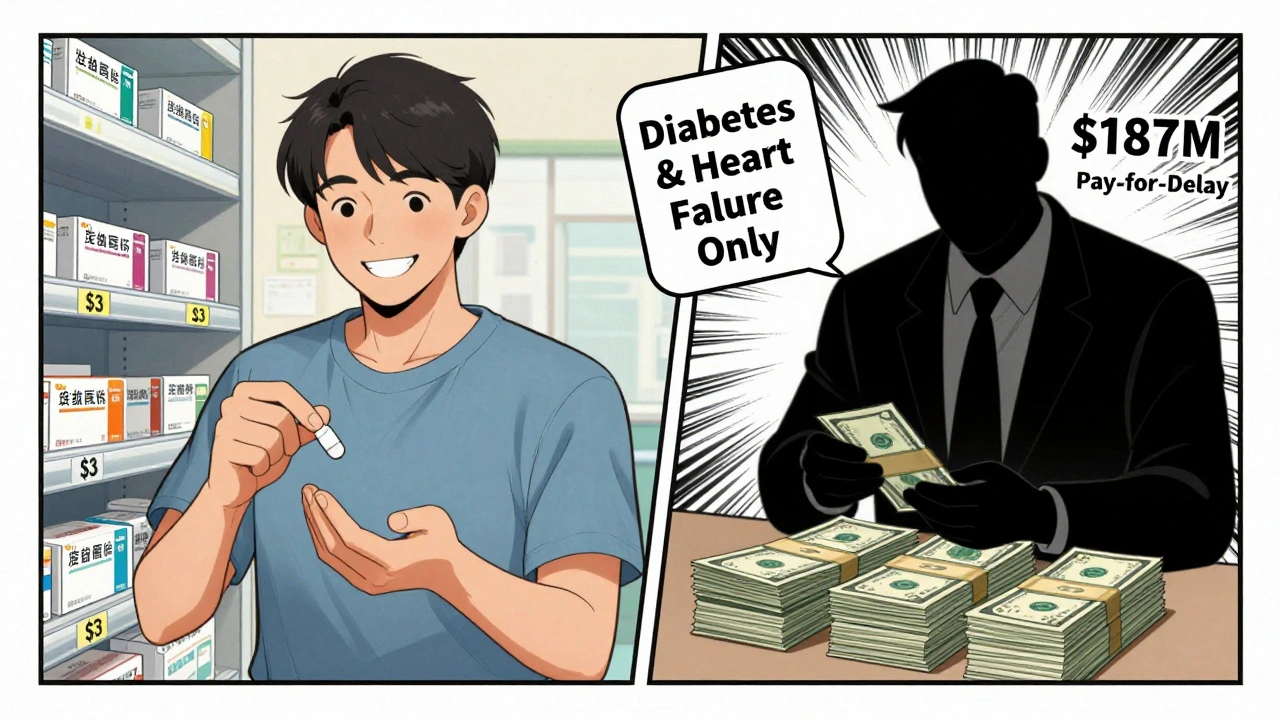

In 2023 alone, first-filer generics made $4.7 billion from this exclusivity window. But it’s not guaranteed. Many companies settle with brand-name firms instead of going to trial. These “pay-for-delay” deals-where the brand pays the generic to delay entry-happened in 68% of cases in 2024. The average payment? $187 million per deal. The FTC has sued 17 of these deals since 2023, calling them anti-competitive.

Some generics take the risk and launch “at-risk”-meaning they start selling before the court decides. If they win, they keep the profits. If they lose, they pay millions in damages. In 2024, 22% of Paragraph IV challengers went this route. The average pre-launch revenue? $83 million. The average potential liability? $217 million.

The Skinny Label Trick: Selling Without Infringing

Not every generic needs to take on every patent. Sometimes, they use something called a “Section viii carve-out.”

Imagine a drug approved for three conditions: diabetes, heart failure, and weight loss. The brand holds a patent only on the weight loss use. The generic company can still launch a version-but only for diabetes and heart failure. They remove the weight loss indication from their label. That’s called a “skinny label.”

This avoids infringement entirely. No need to challenge the patent. No lawsuit. No 30-month delay. And it’s legal. In fact, about 37% of Paragraph IV filings in 2023 used this tactic. It’s smart, efficient, and often faster than full-blown litigation.

Who’s Winning and Who’s Losing

On the generic side, Teva led the pack in 2024 with 147 Paragraph IV filings. Mylan, Sandoz, and Hikma weren’t far behind. On the brand side, AbbVie’s Humira faced 28 challenges. Eli Lilly’s Trulicity and Pfizer’s Eliquis each faced over 20. These are the drugs with the biggest profits-and the most patents.

But the real winners? Patients. Since 1984, Paragraph IV challenges have saved U.S. consumers $2.2 trillion in drug costs. In 2024 alone, the savings hit $192 billion. That’s because generics are typically 80-90% cheaper than brand drugs.

Still, the system isn’t perfect. Generic companies spend an average of $12.3 million per challenge, and cases take nearly 29 months to resolve. Many get delayed by “procedural delays” that stretch the 30-month stay to 36 months or longer. One survey found 63% of generic firms had at least one 30-month stay extended in 2023-adding $8.7 million in holding costs per drug.

What’s Changing in 2025 and Beyond

The FDA updated its rules in October 2022 to close loopholes. Now, if a generic company wants to change its certification after a court ruling-for example, if they switch to a different crystal form of the drug-they must prove the change doesn’t create a new product. This stops companies from gaming the system with minor tweaks.

Also in 2025, the FDA proposed a new rule that would require brand companies to justify every patent they list in the Orange Book. Analysts believe this could cut patent thickets by 30-40%. That means fewer lawsuits, faster approvals, and more competition.

Meanwhile, generic success rates are rising. From 2003 to 2019, generics won about 41% of Paragraph IV cases. Since 2020, that number jumped to 58%. Why? Supreme Court decisions have narrowed what kinds of patents are eligible. If a patent is just for a slight variation in dosage or packaging, courts are more likely to throw it out.

And while biosimilars (generic biologics) don’t yet have a Paragraph IV equivalent, that’s changing. The system is being watched closely. If it works for small-molecule drugs, it could be adapted for complex biologics too.

Why This Matters to You

Whether you’re paying for a prescription, working in healthcare, or just trying to understand why your medication costs less now than it did five years ago-Paragraph IV certifications are why.

This isn’t just legal jargon. It’s a system that balances innovation and access. It lets companies profit from their research, but also forces them to defend their patents fairly. And it gives generic makers a real shot at bringing down prices-without waiting a decade.

For patients, that means lower costs. For the system, it means more transparency. For the future? It means more drugs, sooner.

What happens if a generic company doesn’t file a Paragraph IV certification?

If a generic company doesn’t file a Paragraph IV certification, they must wait until all patents on the brand drug expire before the FDA can approve their product. This can delay market entry by years-even if the drug’s patent protection is outdated or weak. Without a certification, there’s no legal shortcut to challenge the patent early.

Can a brand-name company stop a Paragraph IV challenge?

They can’t stop it, but they can delay it. If the brand company files a lawsuit within 45 days of receiving the notice, the FDA imposes a 30-month stay on approval. This gives them time to litigate. Many use this delay to negotiate settlements, sometimes paying the generic to postpone entry. These "pay-for-delay" deals are under scrutiny by the FTC.

How long does a Paragraph IV challenge usually take?

On average, it takes 28.7 months from the time the ANDA is filed until the case is resolved. That includes court proceedings, appeals, and possible settlements. The 30-month FDA stay often stretches longer due to delays in court scheduling or procedural motions. Some cases resolve in under a year; others take over four years.

Why do generic companies risk an "at-risk" launch?

An "at-risk" launch means the generic company starts selling before the court rules. They do this because the 180-day exclusivity window is so valuable. If they win, they capture the entire market early. If they lose, they face huge damages-sometimes over $200 million. But for high-revenue drugs, the potential profit outweighs the risk. About 22% of generics took this route in 2024.

Are Paragraph IV certifications only used in the U.S.?

Yes. The Paragraph IV mechanism is unique to the U.S. under the Hatch-Waxman Act. Other countries have different systems for generic drug approval and patent challenges. For example, the EU uses a centralized approval process with separate patent litigation rules. The U.S. system is the only one that treats the filing of a generic application as an act of infringement.

10 Comments

They’re just gaming the system with patent thickets like it’s a video game-stacking patents on pill coatings like it’s some kind of legal Jenga. The FDA’s new rules won’t fix this, trust me, I’ve seen this movie before.

So let me get this straight-you’re telling me a company can file a legal notice saying ‘we think your patent is BS’ and then get a 180-day monopoly on a drug they haven’t even made yet? That’s not innovation, that’s legalized extortion.

The Hatch-Waxman Act was a masterstroke of regulatory engineering. It forced innovation to compete with access. The math is brutal: $2.2 trillion saved since 1984. That’s not a loophole-it’s justice.

Let’s be real: the 180-day exclusivity window is the real reason generics even bother. It’s not about patient access-it’s about turning litigation into a lottery ticket. $500 million for one company? That’s not capitalism-it’s a casino rigged by the FDA.

What’s fascinating is how the U.S. system stands alone. In the UK, we don’t treat filing a generic application as infringement-we just let the courts sort it out after launch. The American approach is aggressive, yes-but it works. Patients win, even if the lawyers win bigger.

For anyone who’s ever had to choose between their medication and their rent-this is why we fight. Paragraph IV isn’t just legal jargon-it’s the reason my grandmother can afford her blood pressure pills. This system isn’t perfect, but it’s the closest we’ve got to fairness in pharma.

At-risk launches are dumb. Paying $217 million to save $83 million doesn’t make sense unless you’re betting on a broken system.

Skinny labels are genius. Why fight a patent when you can just… not use the part it covers? It’s like selling a hammer without the nail-still useful, no lawsuit. This is how smart companies play the game.

Real talk: the real heroes here aren’t the lawyers or the CEOs-they’re the scientists at Teva and Sandoz who spent years reverse-engineering drugs just to give people a shot at living. And yeah, they’re in it for the money too-but so what? If they can make insulin affordable, I’m not mad at them.

22% going at-risk? That’s insane. And the fact that 68% of cases settle with pay-for-delay? This whole thing is just a slow-motion corporate dance where patients pay the price in silence.

Write a comment