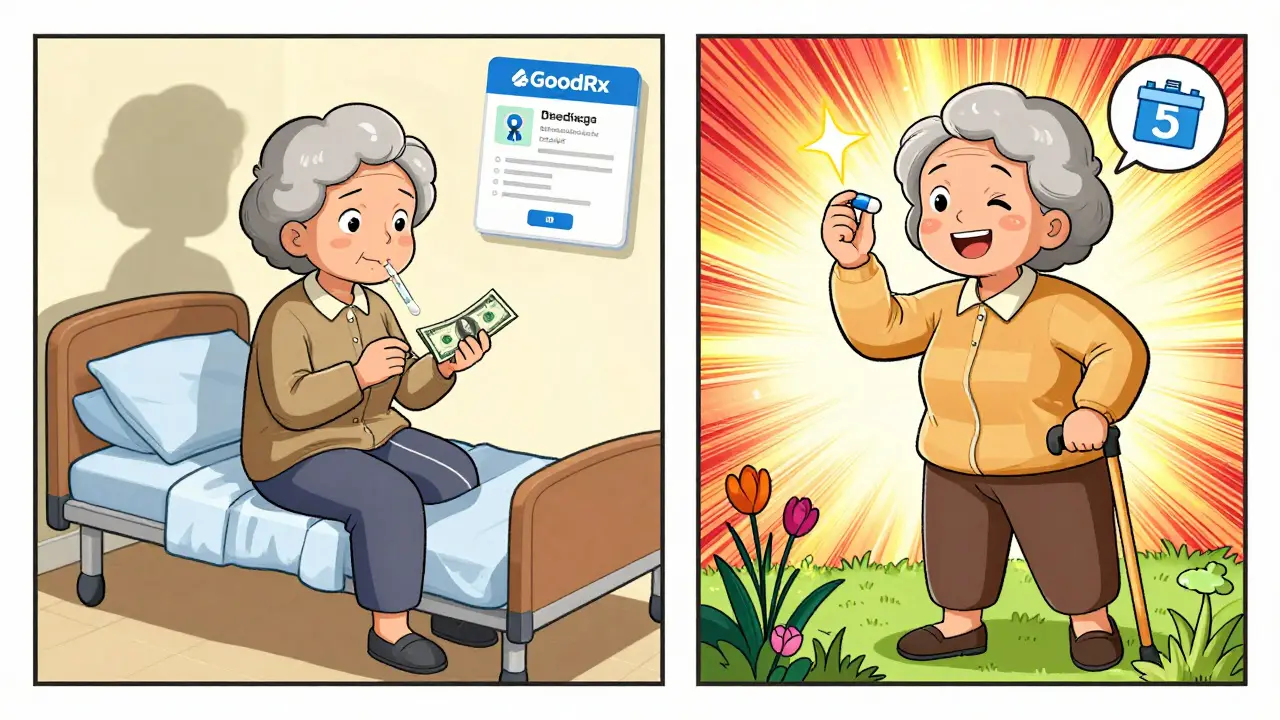

When a doctor prescribes a medication, the goal is simple: the patient takes it as directed. But for millions of people in the U.S., that doesn’t happen-not because they don’t care, but because they can’t afford it. The price tag on a prescription can make the difference between getting better and getting worse. And when it comes to cost, generic drugs are the quiet hero in this story.

Generic medications work the same way as brand-name drugs. They contain the exact same active ingredients, come in the same strength and form, and are held to the same strict standards by the FDA. The only real difference? Price. Generics cost 80 to 85% less than their brand-name counterparts. That’s not a small discount-it’s life-changing for people on fixed incomes, those without good insurance, or anyone juggling rent, food, and medicine.

Here’s what happens when prices drop: people actually take their pills. A landmark study of Medicare Part D beneficiaries showed that when the cholesterol drug rosuvastatin moved from a higher-cost tier to a lower one, adherence jumped by 5.9%. That might sound small, but in real terms, it means thousands of people avoided heart attacks, strokes, and hospital stays because they kept taking their medication. The same pattern shows up across conditions-from diabetes to high blood pressure to breast cancer. When copays go down, adherence goes up.

The math is clear. For every $10 increase in out-of-pocket cost, adherence drops by 2 to 4%. For GLP-1 receptor agonists used in diabetes, each extra $10 cuts adherence likelihood by 3.7%. That’s not theoretical-it’s backed by data from the Diabetes Care Journal and other peer-reviewed studies. And the consequences of skipping doses? They’re severe. Medication non-adherence leads to 100,000 preventable deaths every year in the U.S. and adds $100 to $300 billion in avoidable healthcare spending. That’s more than what the entire Medicare Part D program spends annually.

One patient on Reddit put it plainly: “I was missing 3 to 4 doses a week on brand-name Crestor-$75 a month. Switched to generic rosuvastatin at $5. I haven’t missed a dose in 11 months.” This isn’t an outlier. A 2023 JAMA Network Open survey found that 32.7% of adults admitted to skipping, cutting, or delaying meds because of cost. Of those, 78% said they’d stop or delay treatment if they found out the real price was higher than what their app showed. That’s a system failing people at the point of care.

Why does this happen? It’s not just about the sticker price-it’s about how insurance structures costs. Tiered formularies push expensive brand-name drugs into the highest copay tiers, sometimes $100 or more. Meanwhile, generics sit in Tier 1 with $5 to $15 copays. Patients aren’t irrational-they’re responding to incentives. If a $75 pill doesn’t feel worth the risk of a missed paycheck, they’ll skip it. But if the same drug costs $5? They take it. And that’s exactly what happened when Medicare moved statins and aromatase inhibitors to lower tiers. Adherence improved. Hospitalizations dropped. Costs went down.

Even when patients know generics are just as effective, fear holds them back. “Is it really the same?” is a common question. That’s why the FDA’s “It’s Okay to Use Generics” campaign matters. It’s not just marketing-it’s education. Generics aren’t cheap because they’re low quality. They’re cheap because manufacturers don’t have to spend billions on clinical trials. The FDA requires them to prove they deliver the same amount of medicine into the bloodstream as the brand name, within a tight 80-125% range. That’s not guesswork. That’s science.

And it’s not just about switching from brand to generic. It’s about making the system smarter. Real-time benefit tools (RTBTs), which show drug prices at the moment a doctor writes a prescription, are changing the game. In pilot programs, these tools improved adherence by 12-15%. One pharmacy benefit manager, Magellan, reported a 40% reduction in care gaps and a 2:1 return on investment. That means for every dollar spent on the tool, two dollars were saved in avoided ER visits and hospitalizations.

The biggest change is coming with Medicare Part D’s new $2,000 annual out-of-pocket cap in 2025. Right now, seniors hit a coverage gap where they pay everything out of pocket until they hit catastrophic coverage. That’s a financial cliff. The cap will eliminate it, and the Congressional Budget Office estimates it will help 1.4 million Medicare beneficiaries stick to their meds. That’s not just policy-it’s prevention.

Still, challenges remain. Many patients don’t know how to compare prices across pharmacies. That’s where tools like GoodRx help. A quick check might show that one pharmacy sells generic metformin for $4, while another charges $35. That’s not a typo-it’s the broken pricing system. Pharmacists can help, but they need time and training. Primary care providers need better access to formulary data. And insurers need to stop making patients jump through hoops just to get a $5 pill.

There’s also the issue of therapeutic duplication-prescribing multiple drugs for the same condition. One study found this accounts for 20-30% of preventable drug costs. A medication therapy management program, where a pharmacist reviews all a patient’s meds, can cut that down. It’s not glamorous work, but it saves lives and money.

Across the OECD, Americans pay 256% more for brand-name drugs than people in Canada, Germany, or Japan. Yet we still use generics for 90% of our prescriptions. That’s not because we’re smarter-it’s because we have no choice. Generics are the only affordable option for most. And when they’re priced right, they work better than brand names-not because they’re stronger, but because people actually take them.

The data doesn’t lie. Lower prices lead to better health. Simpler systems lead to fewer mistakes. And when patients can afford their meds, hospitals see fewer admissions, emergency rooms see fewer visits, and lives get longer. The solution isn’t complicated. It’s just been ignored for too long.

Doctors can ask: “How much does this cost you?” Pharmacists can show: “This generic is $5 here.” Insurers can design plans that reward adherence, not punish it. And patients? They just need to know they’re not alone-and that their health matters more than their bill.

Why Generic Drugs Are Just as Effective as Brand Names

Many people believe generics are “weaker” or “inferior.” That’s a myth. The FDA requires generics to have the same active ingredient, dosage form, strength, and route of administration as the brand-name drug. They must also prove bioequivalence-meaning they deliver the same amount of medicine into your bloodstream at the same rate. The allowed range? 80-125% of the brand-name drug’s performance. That’s not a loophole-it’s a scientifically proven safety margin.

For example, generic atorvastatin works exactly like Lipitor. Generic metformin works the same as Glucophage. Generic sertraline is identical to Zoloft. The fillers, dyes, or coating might differ slightly-but those don’t affect how the drug works in your body. In fact, many brand-name drugs are made in the same factories as generics. The difference? Marketing.

Studies comparing clinical outcomes show no meaningful difference in effectiveness between generics and brands. A 2021 review in U.S. Pharmacist found adherence rates were 15-20% higher for generics-even when both drugs were priced similarly. Why? Because patients trust the lower cost. They don’t feel guilty taking a $5 pill. They feel like they’re doing something smart.

How Insurance Tiers Make or Break Adherence

Insurance plans use tiers to control costs. Tier 1: generics. Tier 2: preferred brands. Tier 3: non-preferred brands. Tier 4: specialty drugs. The higher the tier, the more you pay.

For a brand-name statin, copays can be $75-$100. For the generic? $5-$15. That’s not a typo. That’s a 90% drop in cost. And when that happens, adherence spikes. A 2012 study of Medicare patients showed that moving a drug from Tier 2 to Tier 1 increased adherence by 5.9%. That’s not a minor bump-it’s a turning point.

But here’s the problem: patients don’t always know which tier their drug is in. Pharmacists might know, but doctors often don’t. That’s why real-time benefit tools are so powerful. When a doctor types in a prescription, the system instantly shows the patient’s out-of-pocket cost. That allows them to choose a lower-cost alternative before the patient even leaves the office.

What Happens When People Skip Their Medication

Skipping pills doesn’t just mean “not feeling better.” It means complications. For someone with high blood pressure, missing doses raises the risk of stroke. For someone with diabetes, it means nerve damage, kidney failure, or amputation. For someone on antidepressants, it can trigger a relapse. For someone on blood thinners? A clot that could kill them.

Medication non-adherence causes up to 50% of treatment failures. It leads to 100,000 preventable deaths a year. And it costs the U.S. healthcare system between $100 billion and $300 billion annually. That’s more than the entire budget of the CDC.

And yet, the most common reason people skip meds? Cost. Not forgetfulness. Not side effects. Not distrust. Cost.

Real Solutions Already Exist-Here’s How to Use Them

- Ask your doctor: “Is there a generic version?” Always.

- Use GoodRx or SingleCare to compare pharmacy prices before you fill.

- Ask your pharmacist: “Can I get this for less if I pay cash?” Sometimes the cash price is lower than your copay.

- If you’re on Medicare, check if your drug is on Tier 1. If not, ask your plan about a formulary exception.

- Ask your provider if they use real-time benefit tools. If not, suggest it.

- If you can’t afford your meds, ask about patient assistance programs. Most drugmakers offer them.

What’s Changing in 2025-and Why It Matters

The Inflation Reduction Act of 2022 is already making waves. By 2025, Medicare Part D will cap out-of-pocket drug spending at $2,000 per year. Insulin will cost no more than $35 per month. The coverage gap-the “donut hole”-will disappear.

These aren’t just policy changes. They’re lifelines. An estimated 1.4 million Medicare beneficiaries will see improved adherence because of these reforms. That means fewer hospital stays, fewer emergency room visits, and more people managing their conditions at home.

And it’s not just Medicare. Private insurers are starting to follow. Value-based insurance design-where copays are tied to a drug’s clinical value, not its price-is being tested in diabetes and heart disease programs. Early results show 18.3% higher adherence for high-value meds.

The future isn’t about more drugs. It’s about making the right drugs affordable and easy to take.

14 Comments

I was paying $80 a month for my statin until I switched to generic. Now it's $4 at Walmart. I haven't missed a dose in over a year. My BP is down, my doctor is shocked, and I finally feel like I'm not just surviving.

People don't get it until they're the one choosing between pills and groceries.

They want you to think generics are fine but they're not

My cousin took a generic antidepressant and started seeing ghosts. Like literally. Said the pills were whispering to him. They didn't even test for that. FDA is a joke. Big Pharma owns them. I know things.

5.9% adherence increase? That's statistically insignificant. The real savings come from reducing ER visits. Look at the cost per avoided hospitalization. That's where the ROI lives.

So we're just supposed to trust that a pill made in India is the same as one made in the US? That's not science. That's corporate greed dressed up as compassion.

I used to work in a pharmacy. People would cry when they saw the price of their brand-name meds. Then we'd switch them to generic and they'd just stare at the receipt like it was magic. One lady said "I thought I was gonna die if I couldn't afford it."

It's not about the science. It's about dignity.

In India, generics are the only option. We don't have the luxury of brand names. But we have high adherence because we know what happens when you stop. My uncle took his BP meds daily for 12 years on $2/month. He's still alive. That's not luck. That's discipline.

Bioequivalence range is 80-125%. That's a 45% variance. That's not the same. That's a gamble. And for chronic conditions? You're playing Russian roulette with your health.

Ah yes, the classic "generic is cheaper so it's better" narrative. Tell that to the guy whose liver failed because his generic metformin had a bad batch. The FDA doesn't inspect every factory. And you think the Chinese plant cares if your blood sugar spikes?

They're lying about the price drop. The real cost is hidden in your insurance premiums. You think you're saving? You're just paying more every month so they can make you feel good about taking a $5 pill. It's a trap.

America's healthcare system is broken because we let foreigners make our medicine. We used to make pills here. Now we import them from places that don't even follow our laws. This isn't progress. It's surrender.

i just found out my generic omeprazole is made in the same factory as prilosec 😳

so like... we've been paying $100 for a placebo this whole time? 🤡

The data is clear. Lower cost equals better outcomes. It's not about ideology. It's about human behavior. When people can afford their meds, they take them. Simple. No drama. Just science and compassion.

I know someone who took a generic blood thinner and almost died 💔 The pharmacy switched it without telling her. Now she’s terrified of ALL generics. I don’t blame her. 😭 #GenericFear

If you're still on brand-name meds and can't afford it, talk to your pharmacist. Ask about patient assistance programs. Most companies have them. I've helped people get free meds for years. You're not alone. We got you 💪

Write a comment